Why use a Chiropractic Broker to Sell Your Practice?

After many years of hard work, long hours, and substantial investment that go into building a chiropractic practice, you're now thinking about selling the practice. It's easy to assume that the practice will sell quickly and for a great price when you are ready to sell. Feedback from doctors who have recently sold their practices shows that the process is more complicated and stressful than anticipated. This is why it is essential to hire a chiropractic broker to help guide you through the process.

Potential individual buyers and corporate buyers will have experts who can help them navigate the sale. You will also need someone to advocate for you and help you understand the process from start to finish. In most cases, the last time you were involved in a practice sale was when you bought the practice, which means you need someone to help you navigate the process.

Benefits of Hiring a Broker

Here are just a few reasons why hiring a chiropractic broker to assist with planning and selling your practice would be a sound investment:

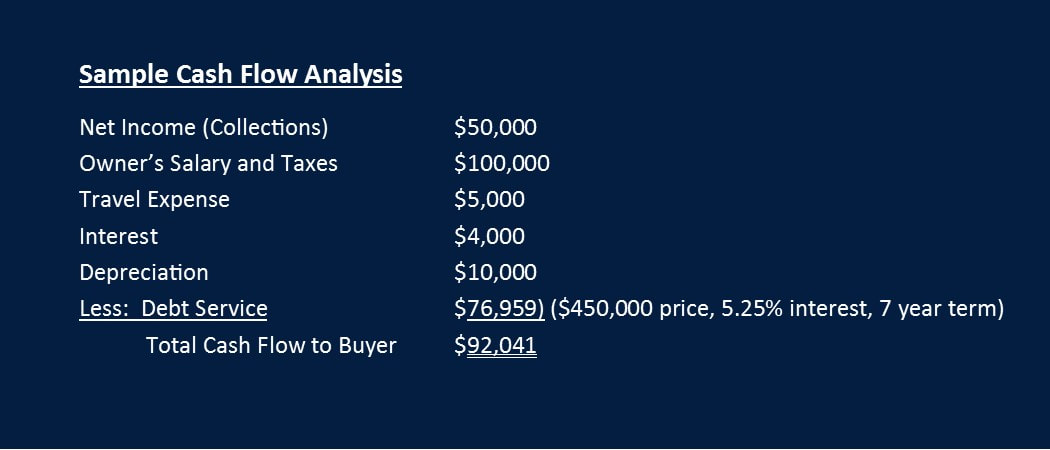

Determining Fair Market Price - At Omni Practice Group, we have certified practice appraisers that put together a valuation to maximize a fair market sales price for the practice and real estate (if applicable).

Develop a Marketing Plan for the Practice while Maintaining Confidentiality - Omni provides confidential marketing and advertising services for your practice that do not identify you or your practice until a buyer is screened and signs a confidential Non-Disclosure Agreement. Omni also provides the financial prospectus for your practice along with confidential personal showings of the practice to potential buyers. Finding the right buyer that you will want to take over your practice can take some time. Good practices can sell quickly, but some can take months or even a year to sell.

Letter of Intent - Omni brokers negotiate on your behalf, a Letter of Intent with your approval for the purchase price of the Practice and the Accounts Receivable. Your broker will also guide you through the due diligence conditions for bank financing, help negotiate a new lease agreement, non-compete agreements, and other conditions that both the seller and the buyer will agree on. If real estate is included, your Omni broker will determine the value of the real estate with a “Broker’s Real Estate Opinion” that is used to market the real estate with the practice.

Finalizing the Sale - Your Omni broker works with you to determine a possible closing date based on whether your practice has real estate to sell or a lease that will be negotiated with the new owner. Omni's brokers work with attorneys to finalize the Asset Purchase Agreement for both the seller and the buyer.

Omni’s 70-point-plus checklist helps guide both the seller and the buyer through the process of items to be completed prior to the sale closing.

A banker at one of the major banks recently said a “High percentage of deals that fall apart is due to the seller not using a chiropractic broker.” Using a broker typically saves sellers a lot of time, money, and headaches in selling their practices.

Omni Practice Group has been helping chiropractors for over 10 years with the planning and transitioning of their practices. If you’re thinking about selling now or in the next few years, give us a call for a “free consultation” to help you determine a plan that works for you and how we can assist with a smooth and profitable transition. 877-866-6053, [email protected]

RSS Feed

RSS Feed