Cash is king is an old adage used to describe one of the keys to success in business as well as personal finances. Cash is essentially physical money or liquidity you have available. While cash may be king when it comes to having cash on hand, another vitally important ingredient to the success of a practice is Cash Flow. Cash Flow is the amount of money you have available in a given time period after you have paid all of your expenses (payroll, lab, supplies, debt, etc.).

When analyzing a practice, how do you know how much true cash flow the practice has available? You cannot simply look at a practice’s tax return or a profit and loss statement and know how much cash flow the practice has. There are a number of steps that someone evaluating a practice would take into consideration when determining the correct cash flow. Those steps are as follows:

When analyzing a practice, how do you know how much true cash flow the practice has available? You cannot simply look at a practice’s tax return or a profit and loss statement and know how much cash flow the practice has. There are a number of steps that someone evaluating a practice would take into consideration when determining the correct cash flow. Those steps are as follows:

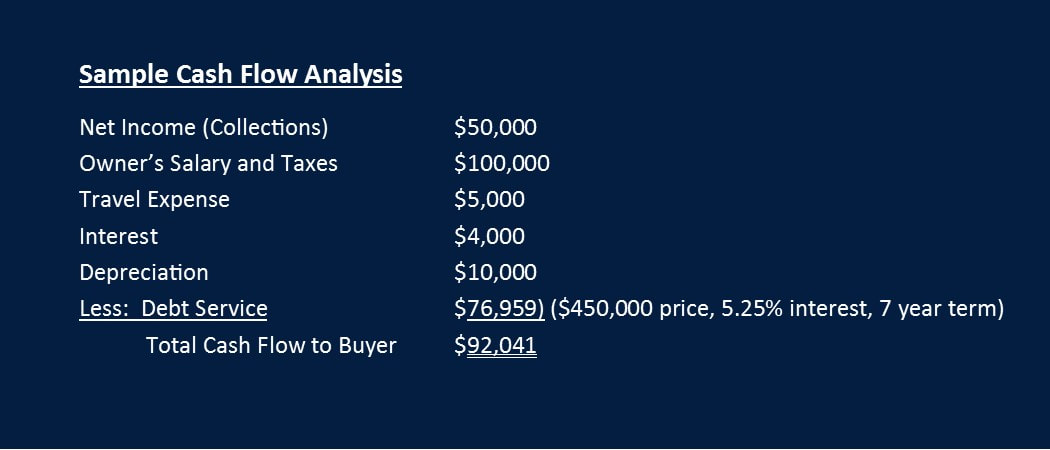

- Start with the Net Income of the practice. This is the total revenue or collections minus the total expenses.

- Add back the owner’s salary and any taxes associated with the owner’s salary.

- Go through the expenses and “add back” those items that are non-essential to the practice. These are expenses that are for extra-curricular or out of the ordinary expenses. These typically include travel, staff meetings, interest, depreciation, owner life insurance, etc.

- Calculate what your debt service payments will be by using a mortgage amortization calculator. You can use bankrate.com or another online calculator. Use a conservative interest rate based on current market rates for practice loans and a 7-year term. Subtract the debt service payments from the above 3 items.

- The result will be the cash flow to the practice after debt service based on the current state of the practice. This will be how much is available to a potential buyer for his/her personal salary, upgrades, updates, etc.

This Sample Cash Flow Analysis shows that without changing a thing, you will earn $92,041 from the practice after paying the note payment on the loan. Note that you can’t stop here. If the cash flow looks low, there may be a reason. The current state of the practice may not be the best run practice. Perhaps salaries are too high, the owner uses the most expensive vendors, or they employ a family member to clean the office at a high salary. There may also be procedures in the practice that the current doctor does not do, but you can. If you keep looking at a low cash flow practice and know how to fix the problems, you may have stumbled upon an incredible opportunity.

If you need help analyzing the cash flow of a practice, or how you can improve a practice, you can call us anytime for a free consultation. We can be reached at (877) 866-6053 or email at [email protected].

Correction: In a previous version of this post, Net Income was incorrectly labeled Gross Income in the calculation of Cash Flow. We apologize for the error and any confusion.

If you need help analyzing the cash flow of a practice, or how you can improve a practice, you can call us anytime for a free consultation. We can be reached at (877) 866-6053 or email at [email protected].

Correction: In a previous version of this post, Net Income was incorrectly labeled Gross Income in the calculation of Cash Flow. We apologize for the error and any confusion.

RSS Feed

RSS Feed